In the dynamic business landscape of the United Arab Emirates (UAE), adherence to International Financial Reporting Standards (IFRS) is paramount. With the implementation of corporate tax and the growing demand for transparent financial reporting, businesses must align their accounting practices with IFRS Compliance UAE to remain compliant and competitive.

This in-depth guide explores UAE accounting standards with a focus on IFRS compliance and shows how ProAct Chartered Accountants—trusted by over 750 UAE-based SMEs and enterprises—can assist.

Understanding IFRS and Its Importance in the UAE

What is IFRS?

International Financial Reporting Standards (IFRS) are global accounting standards set by the International Accounting Standards Board (IASB). They ensure financial statements are consistent, transparent, and comparable internationally.

Why IFRS Compliance Matters in the UAE

The UAE has adopted IFRS as the standard for financial reporting. Compliance is crucial for:

- Regulatory adherence to FTA and Ministry of Economy requirements

- Investor confidence through transparent reporting

- Facilitating international trade and cross-border investment

Businesses operating under UAE corporate tax laws are expected to produce IFRS-compliant statements starting from their first tax period post-June 1, 2023.

Learn more about ProAct’s accounting services

Key UAE Accounting Standards Under IFRS

IFRS for SMEs

Applicable to businesses with annual revenue less than AED 50 million. It simplifies full IFRS and is ideal for small firms needing compliance without complexity.

Major IFRS Standards in UAE Application:

- IFRS 9: Financial Instruments — classification, measurement, impairment

- IFRS 15: Revenue from Contracts with Customers

- IFRS 16: Lease accounting

- IAS 12: Income Taxes

Each of these impacts how revenue, leases, and taxes are reported in financial statements. ProAct’s team includes certified IFRS advisors with deep expertise in these standards.

Explore ProAct’s tax consultancy services

Industry-Specific IFRS Considerations

Certain sectors in the UAE require nuanced IFRS application:

- Real Estate: Revenue recognition timing under IFRS 15

- Financial Services: IFRS 9 complexity in risk modeling

- Retail & E-commerce: Multi-channel revenue recognition

- Construction: Long-term contracts and performance obligations

Some Free Zones like DMCC or JAFZA may have stricter requirements for IFRS-based audits and timely submission. ProAct has supported firms across these industries with tailored audit preparation and IFRS system integration services.

Book a consultation with ProAct

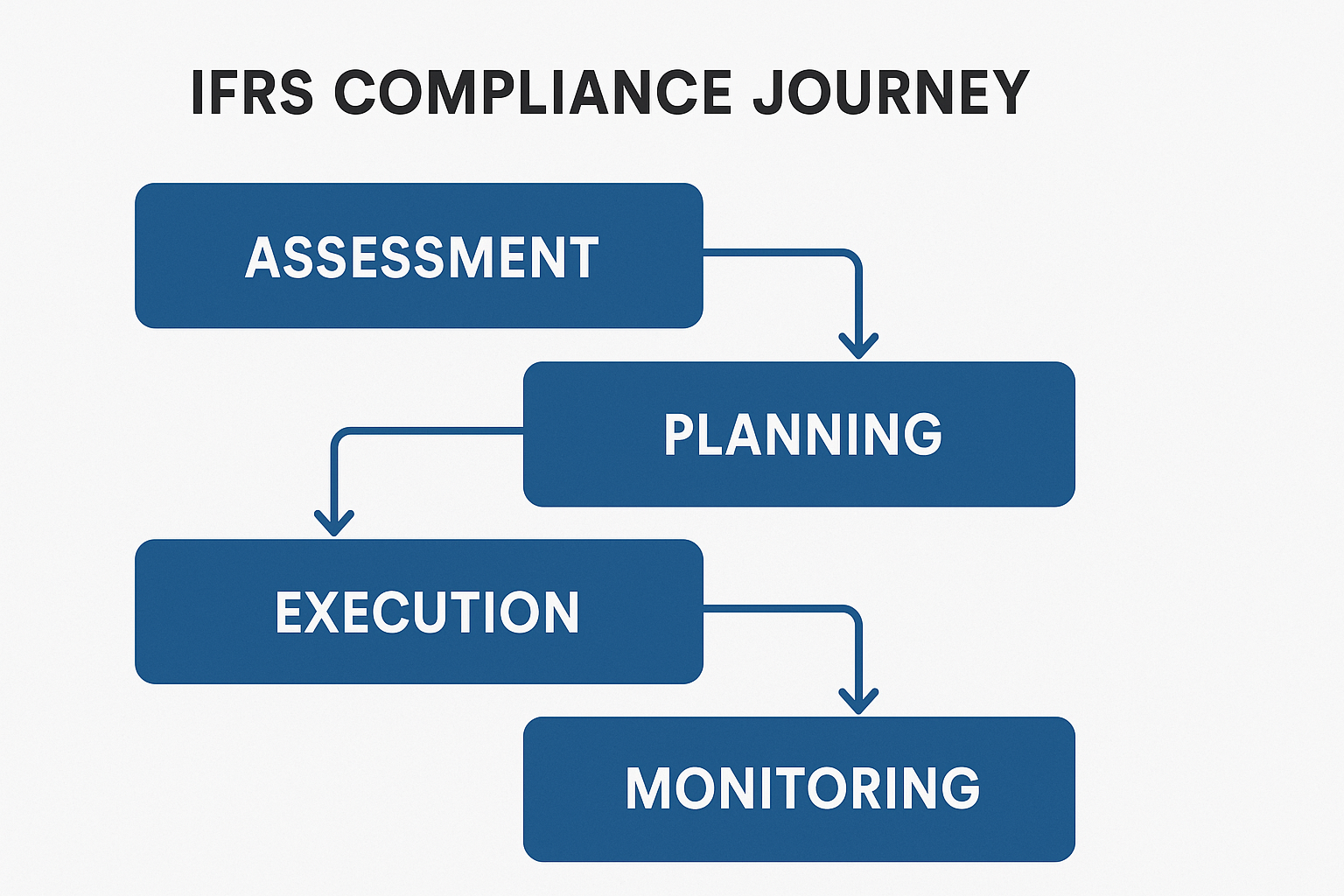

Step-by-Step: How to Achieve IFRS Compliance in the UAE

- Assess current accounting practices

- Gap analysis vs. IFRS standards

- Develop a transition roadmap with timelines and key milestones

- Train internal teams or outsource compliance to certified partners

- Adapt ERP/accounting systems for IFRS-compatible reporting

- Engage ProAct experts for audit preparation, system integration, and ongoing support

- Monitor, review, and improve periodically

Challenges in IFRS Transition and How ProAct Solves Them.

- Lack of internal expertise: ProAct provides training programs and workshops

- Legacy systems: We assist in system integration and upgrades

- SME complexity: Tailored solutions using IFRS for SMEs

Case Study: A Dubai-based e-commerce startup approached ProAct for IFRS conversion. Within 3 weeks, our team redesigned their chart of accounts, trained their finance team, and prepared IFRS-compliant financials for FTA submission.

Benefits of Partnering with ProAct Chartered Accountants

- Certified Experts: Our team includes Chartered Accountants (CA) and IFRS-certified professionals.

- Years of Experience: 10+ years in the UAE market across 7+ sectors

- Trusted by 750+ businesses: From SMEs to large conglomerates

- End-to-End Services: Bookkeeping, system integration, audit preparation, training programs, and VAT filing

Quick Note on Cash Basis vs Accrual

Under UAE Corporate Tax Law, small businesses earning less than AED 3 million may be allowed to use the cash basis of accounting — which is simpler and more suited for micro-entities focused on actual cash-flow. However, the accrual basis offers a clearer financial performance view and is mandatory for larger businesses. ProAct helps assess and implement the most compliant method.

Even if a micro-entity uses the cash basis for corporate tax purposes, they still need to meet IFRS disclosure requirements for financial statements if they are subject to an audit or other regulatory submissions where IFRS is mandated.

This clarifies that the cash basis is primarily a tax election, not a full IFRS exemption.

| Aspect | Cash Basis | Accrual Basis |

|---|---|---|

| Eligibility | Allowed for businesses with < AED 3 million revenue (subject to FTA approval) | Mandatory for most entities above the AED 3M threshold or where required by FTA |

| Recognition Timing | Income and expenses are recorded when cash is received or paid | Income and expenses are recorded when earned or incurred, regardless of cash flow |

| Simplicity | Simpler and more suited for micro or early-stage businesses | Requires detailed accounting systems and is better for larger operations |

| Tax Compliance | Acceptable for corporate tax filing under Article 17 of the UAE CT Law if conditions are met | Required standard for most corporate tax returns |

| Financial Accuracy | Reflects cash position but may distort profit/loss timing | Reflects true financial performance over periods |

| IFRS Compatibility | ❌ Not aligned with IFRS — cash basis is not an accepted financial reporting framework | ✅ Fully aligned with IFRS |

| Audit Acceptance | May be rejected for audit purposes or regulatory filings that demand IFRS-based financials | ✅ Compliant with audits, especially when IFRS statements are required |

| FTA Requirements | Must be formally elected through FTA approval for eligible entities | Automatically expected for entities above threshold |

| Use Case | Suitable for freelancers, small consultancies, and cash-driven trades | Suitable for SMEs, large businesses, entities with inventory or receivables |

| ProAct’s Role | Helps assess eligibility, apply for FTA approval, and prepare simplified tax filings | Assists with IFRS-based bookkeeping, accrual adjustments, audit preparation, and tax compliance |

FAQs: IFRS Compliance in UAE – What Businesses Ask Most

- What is the deadline for IFRS compliance in UAE? Businesses whose first tax period began after June 1, 2023, must comply with IFRS by the end of that financial year.

- Can my startup use IFRS for SMEs? Yes, if your revenue is below AED 50M. ProAct evaluates eligibility and manages transition.

- How does IFRS impact my corporate tax return? IFRS-compliant statements are used as the base for tax calculations, especially under IAS 12.

- What penalties apply for non-compliance? You risk fines, return rejection, or regulatory scrutiny. Avoid penalties by ensuring accurate IFRS alignment.

- Can ProAct handle IFRS training? Yes. We offer workshops, in-house training, and webinars.

- What industries face tougher IFRS requirements? Real estate, financial institutions, construction, and startups in tech sectors.

- Can I outsource IFRS compliance? Absolutely. ProAct offers full outsourcing with monthly or quarterly reviews.

- Do I need to change my accounting software? Possibly. ProAct helps assess and integrate IFRS-ready systems like Zoho, Xero, or Tally.

- Is IFRS mandatory for Free Zone entities? Yes, for tax and audit purposes. Most Free Zones also require IFRS-compliant statements for license renewal.

- Do I need an audit to be IFRS compliant? No, but audited IFRS-compliant statements are required for tax and legal purposes.

- Can ProAct help prepare financial statements? Yes. We prepare, review, and submit fully compliant financials.

- Are IFRS and UAE VAT accounting aligned? Generally yes, but VAT-specific rules must be layered on top. ProAct ensures both are compliant.

- What are IFRS disclosure requirements? Full details on revenue, leases, related party transactions, etc. We help ensure completeness.

- How do I know if I’m already compliant? We offer a free initial assessment for new clients. Request an assessment

- Does ProAct support multi-branch businesses? Yes. We help consolidate across UAE and international branches.

- Can you help during tax audit? Yes. Our audit support team prepares documentations.

- What are the IFRS impacts on financial KPIs? KPI calculations (like EBITDA) may change. ProAct recalibrates reports for compliance.

- What if I made accounting errors? We help restate and amend reports as per IFRS retroactive adjustments.

- Can I download an IFRS checklist? Yes. Download our free checklist PDF

- Is IFRS compliance a one-time job? No. It requires ongoing updates and annual reviews.

Conclusion

Need help navigating IFRS compliance? Contact ProAct Chartered Accountants today to speak to an IFRS-certified advisor or download our IFRS Readiness Checklist.

Soft CTA: Want to know where your business stands? Request a free compliance assessment.

Disclaimer

This article is intended for informational purposes only. It does not constitute legal or tax advice. For tailored guidance on IFRS compliance in the UAE, consult ProAct Chartered Accountants directly.

Author Bio:

Written By,