In a regulatory environment shaped by VAT, Corporate Tax, and FTA audits, understanding your bookkeeping cost in UAE is more than a budgeting exercise—it’s a survival strategy.

Whether you’re managing a startup in Sharjah, an e-commerce firm in Dubai, or a construction business in Abu Dhabi, the cost of accounting services in UAE in 2025 hinges on complexity, compliance, and the provider you choose.

This article offers a comprehensive breakdown of bookkeeping service fees in UAE, pricing factors, and real-world insights to guide your decision—while showing how ProAct can simplify your compliance journey.

What Is Bookkeeping and Why It’s Critical in UAE?

Bookkeeping is the backbone of sound financial management and compliance. It includes:

- Recording transactions

- Reconciling bank accounts

- Managing accounts payable/receivable

- Preparing VAT and Corporate Tax reports

FTA regulations require companies to maintain accurate books for at least 5 years. With UAE’s corporate tax now active, failing to maintain compliant books can lead to severe penalties. Learn more on the FTA’s official guidelines.

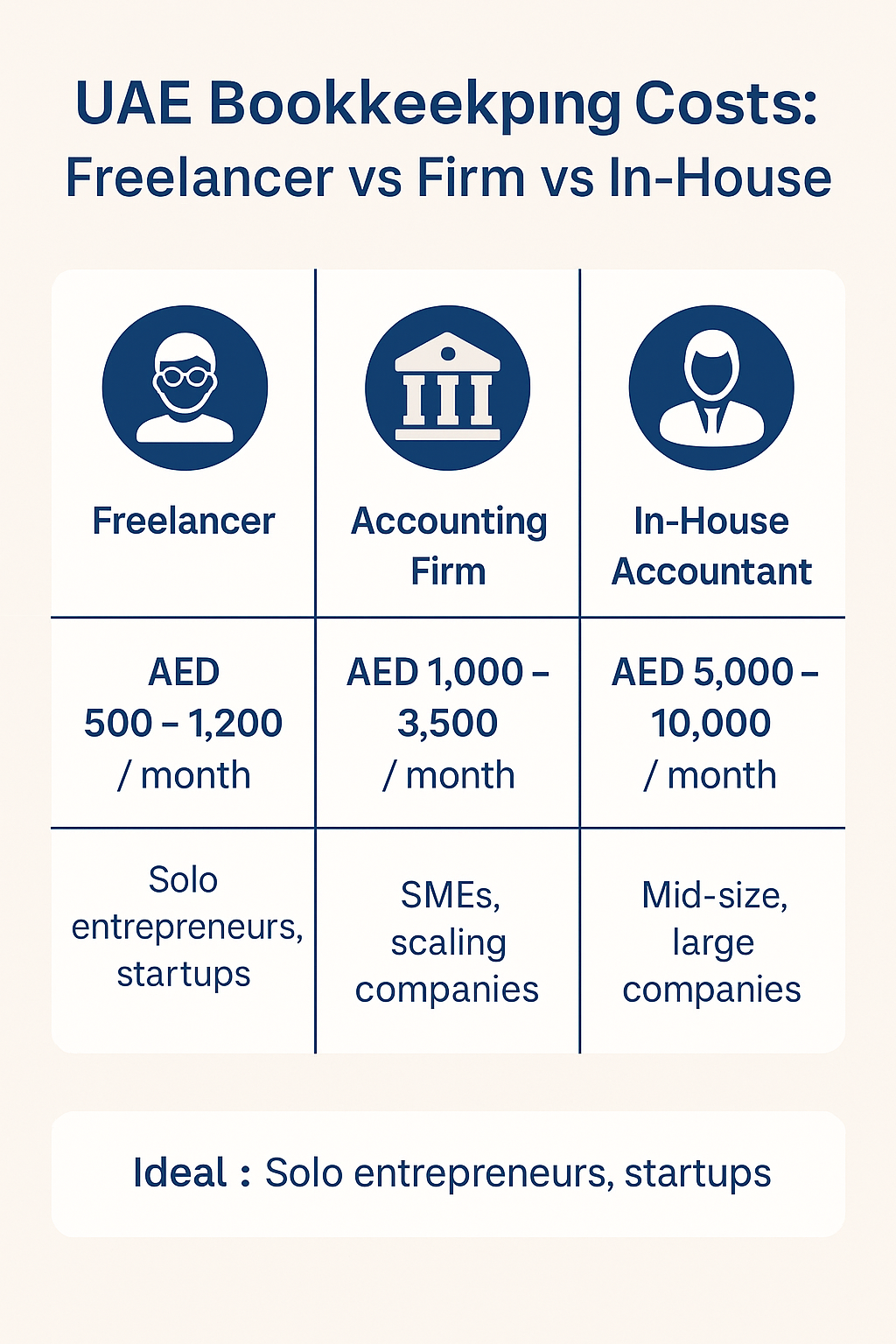

Average Bookkeeping Cost in UAE (2025)

The below are the average Bookkeeping Cost in UAE

| Provider Type | Monthly Cost (AED) | Annual Cost (AED) | Ideal For |

|---|---|---|---|

| Freelance Bookkeeper UAE | 500 – 1,200 | 6,000 – 14,400 | Solo entrepreneurs, startups |

| In-house Accountant | 5,000 – 10,000 | 60,000 – 120,000 | Mid-size firms, finance-heavy sectors |

| Outsourced Accounting UAE Firm (e.g., ProAct) | 1,000 – 3,500 | 12,000 – 42,000 | SMEs, scaling companies |

💡 Pro Tip: Outsourcing is more cost-effective and ensures compliance with FTA and MoE requirements.

What Influences Bookkeeping Cost in the UAE?

1. Business Type and Complexity

- E-commerce: High transaction volume → Higher fees

- Construction: Project-based tracking needed → Specialized software

- Professional Services: Simpler accounting, lower cost

- Retail Chains: Multi-location tracking required

2. Transaction Volume

More invoices = More work = Higher cost.

Example:

- < 50 monthly transactions = AED 700–1,200

- 100–300 = AED 1,200–2,500

- 500+ = AED 2,500+

3. FTA-Preferred Accounting Software Integration

Software like Zoho Books, QuickBooks UAE edition, and Xero are preferred because:

- They offer direct integration with FTA e-Services portal

- Built-in audit trails for tax records

- Enable automated VAT compliance and corporate tax computation

4. Frequency of Reporting

- Monthly bookkeeping is standard.

- Quarterly packages may cost less but risk late filings.

ProAct’s 2025 Bookkeeping Cost Packages

| Package | Monthly Fee (AED) | Inclusions |

| Starter | 700 – 1,500 | Up to 50 transactions, monthly reports, VAT support |

| SME Growth | 1,500 – 2,500 | 100–250 transactions, VAT + CT returns, bank reconciliation |

| Enterprise | 2,500 – 4,000 | Unlimited entries, audit support, CFO insights |

📌 CTA: Get a personalized quote from ProAct for affordable bookkeeping packages.

What’s Included in a Typical Bookkeeping Service?

👉 General ledger entries

👉 Monthly management reports

👉 VAT return filing (FTA-compliant)

👉 Payroll/WPS (optional)

👉 Corporate Tax calculation

👉 Audit-readiness preparation

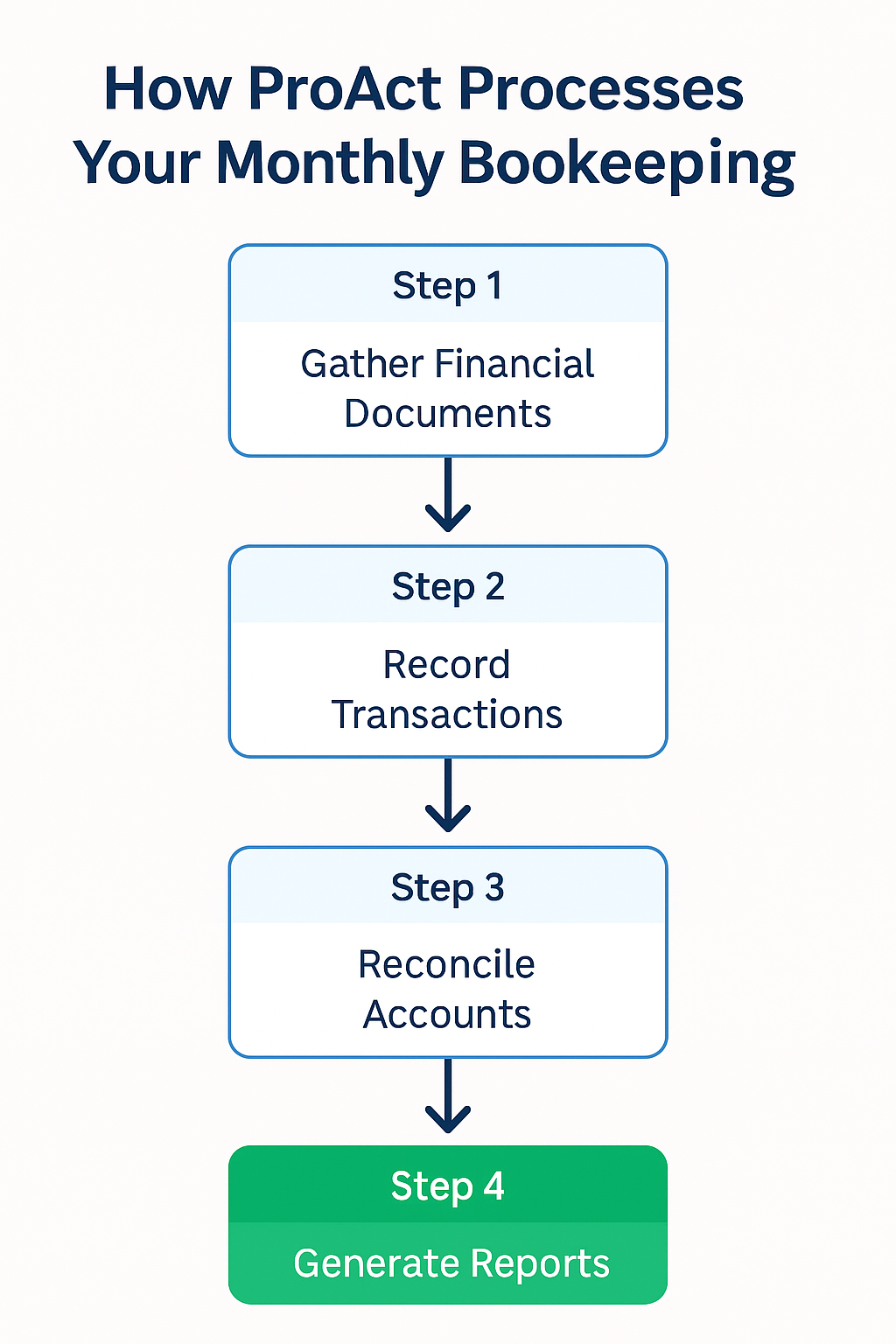

📊 How ProAct Processes Your Monthly Bookkeeping

At ProAct, we follow a streamlined and FTA-compliant monthly bookkeeping workflow designed for accuracy, transparency, and real-time insights:

- Gather Financial Documents: Clients securely submit invoices, bank statements, receipts, and payroll summaries.

- Record Transactions: Our accountants enter and classify transactions using VAT-compliant software like Zoho Books or QuickBooks UAE.

- Reconcile Accounts: We match transactions with bank feeds, detect anomalies, and correct discrepancies.

- Generate Reports: Monthly profit & loss, balance sheets, VAT summaries, and tax-ready statements are delivered.

🔗 Our bookkeeping system is audit-ready by design—ensuring zero-penalty compliance.

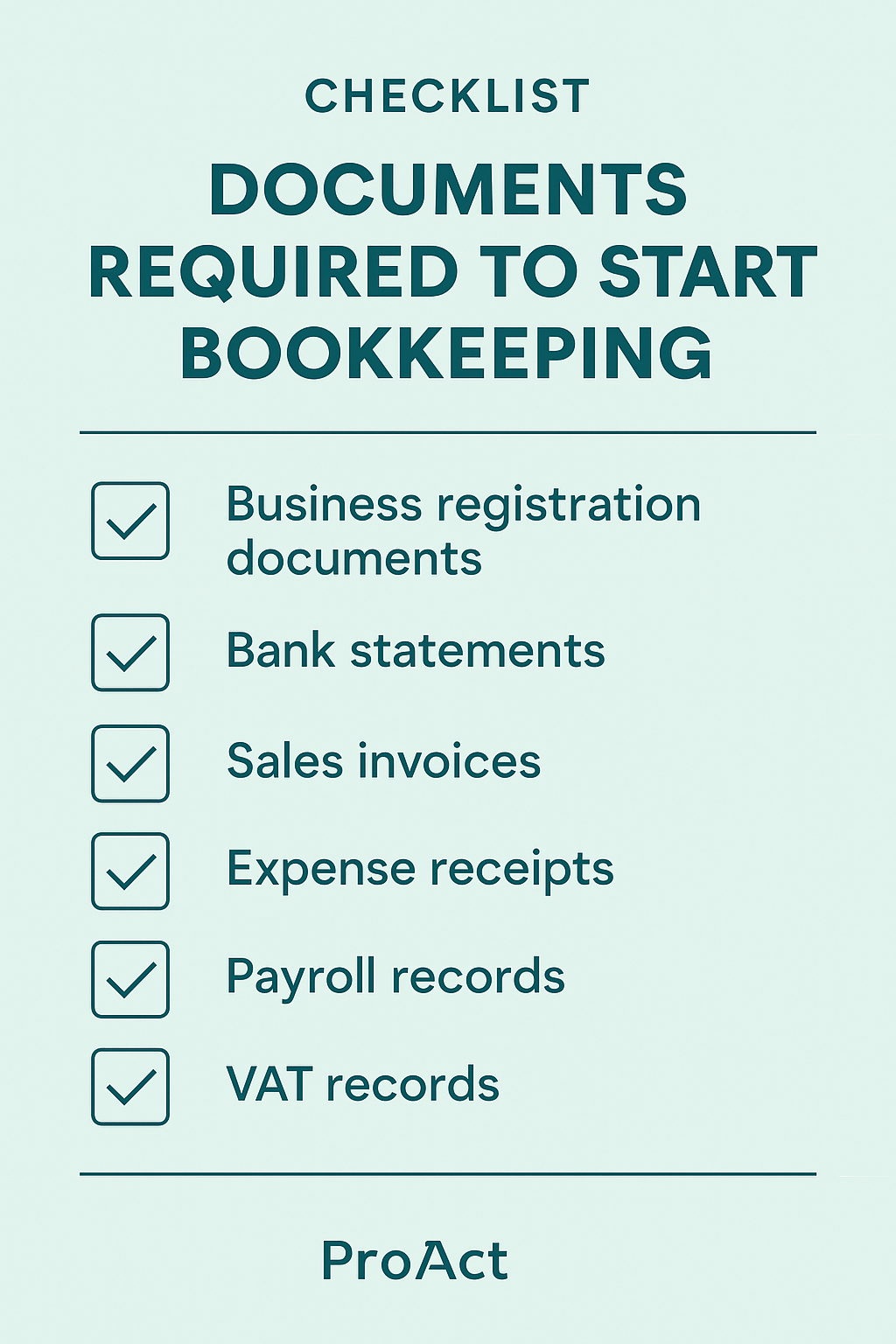

✅ Checklist: Documents Required to Start Bookkeeping

Before we begin, here’s what you’ll need to submit to ProAct for a smooth onboarding process:

- ✔️ Business license / MOA

- ✔️ Bank statements (last 3–6 months)

- ✔️ Sales invoices (issued)

- ✔️ Purchase/expense receipts

- ✔️ Payroll records (if applicable)

- ✔️ VAT registration certificate & previous filings (if any)

💡 Don’t worry—we’ll guide you through every step and provide templates if you don’t have a system in place.

Real-World Example: How ProAct Saved an SME Over AED 40,000

Client: Manufacturing company in Dubai

Challenge: Costly errors with in-house staff

Solution: Switched to ProAct’s outsourced accounting UAE package

Outcome:

- Costs cut by 53%

- Streamlined corporate tax compliance

- Audit readiness achieved in 6 weeks

Free Zone vs. Mainland Bookkeeping Fees

| Factor | Free Zone Companies | Mainland Companies |

| VAT Applicability | Applicable | Applicable |

| Corporate Tax Status | Can Qualify for 0% | Subject to 9% |

| Audit Requirement | Mandatory in most zones | Required for license renewal |

| Cost Range | AED 1,000 – 2,500 | AED 1,500 – 3,500+ |

Corporate Tax Impact on Bookkeeping (2025)

With Corporate Tax now active, bookkeeping is no longer optional:

- Taxable profits must be calculated monthly

- Adjustments (e.g., exempt income, depreciation) must be tracked

- All records must be available digitally for FTA audits

🔗 Learn About Corporate Tax Support

Additional Services That May Affect Your Pricing

| Add-on Service | Fee Range (AED) | Benefit |

| VAT Return Filing | 200 – 600/month | Avoid late penalties |

| Payroll & WPS Setup | 25–75/employee | MoHRE compliance |

| Financial Statement Preparation | 1,000–2,500 | Required for audit |

| Corporate Tax Return Filing | 500–2,000 | Reduce tax errors |

Why ProAct is a Leading Accounting Firm in Dubai & UAE

- 100% FTA-compliant documentation standards

- Cloud-based, real-time dashboards

- Special rates for IFZA, RAKEZ, and DMCC companies

- Proven experience across retail, consulting, trading, e-commerce

Frequently Asked Questions (FAQs) on Bookkeeping Fees in UAE (2025)

1. What is the minimum bookkeeping cost in UAE?

Starts from AED 500/month for freelancers. Firms begin at AED 1,000/month.

2. Can I do bookkeeping myself in UAE?

Yes, but FTA compliance and audit risk make outsourcing safer.

3. What’s the best bookkeeping software in UAE?

Zoho Books, QuickBooks, and Xero—integrated with VAT and CT modules.

4. Are ProAct’s fees fixed or customized?

Customized based on your industry, transaction volume, and compliance needs.

5. Is Corporate Tax increasing bookkeeping costs?

Yes, due to added reporting and reconciliations.

6. What penalties apply for poor bookkeeping?

FTA fines can exceed AED 10,000 for non-compliant records.

7. Can ProAct handle multi-currency accounting?

Absolutely—USD, EUR, INR, GBP, etc., all supported.

8. Do I need bookkeeping if not registered for VAT or CT?

Yes, to track financial health and prepare for future obligations.

9. Can I use Excel for bookkeeping in UAE?

Not recommended—no FTA audit trail or compliance integration.

10. How soon can ProAct onboard my company?

In as little as 3 working days after receiving documents.

11. What’s the billing cycle?

Monthly, quarterly, or annual—based on your preference.

12. Are bookkeeping and accounting different?

Yes. Bookkeeping = recording, Accounting = analysis + compliance.

13. Do I need an audit report for license renewal?

Yes, especially in most free zones and for tax compliance.

14. Is outsourcing bookkeeping legal in UAE?

Yes. Most SMEs in UAE prefer outsourcing to save cost and ensure compliance.

15. Can I hire a freelance bookkeeper on a visit visa?

Legally risky. Firms like ProAct offer licensed, insured services.

16. How often should VAT filings happen?

Quarterly or monthly, depending on FTA registration terms.

17. Can ProAct assist with overdue FTA filings?

Yes, we offer backdated VAT & bookkeeping reconciliation.

18. Does ProAct support Zoho/QuickBooks migration?

Yes. We help migrate, clean, and structure ledgers for compliance.

19. How are invoices and documents shared?

Via secure cloud portal and WhatsApp/Email as needed.

20. How do I get started?

Request your free bookkeeping consultation here

Conclusion

Your business deserves more than reactive accounting—it deserves strategic, compliant, and cost-effective financial oversight. That’s what ProAct delivers daily across Dubai, Abu Dhabi, Sharjah, and all UAE free zones.

📌 Let’s make your books audit-proof and future-ready.

🔗 Bookkeeping Experts You Can Trust – Contact ProAct

Author Bio:

Written By,