The Ministry of Finance made an announcement stating that companies failing to register for UAE Corporate Tax within the specified timelines will face an administrative penalty of Dh10,000.

This penalty aims to ensure compliance with tax regulations and encourage timely registration for corporate tax. The Ministry stated that the penalty amount for late tax registration aligns with the penalties associated with late registration for excise tax and value-added tax (VAT). To implement this, the Ministry issued Cabinet Decision No. 10 of 2024, which amends the schedule of violations and administrative penalties outlined in Cabinet Decision No. 75 of 2023.

The amendments focus on penalties for violations related to the application of Federal Decree-Law No. 47 of 2022 on the taxation of corporations and businesses. Cabinet Decision No. 10 of 2024 will take effect on March 1, 2024.

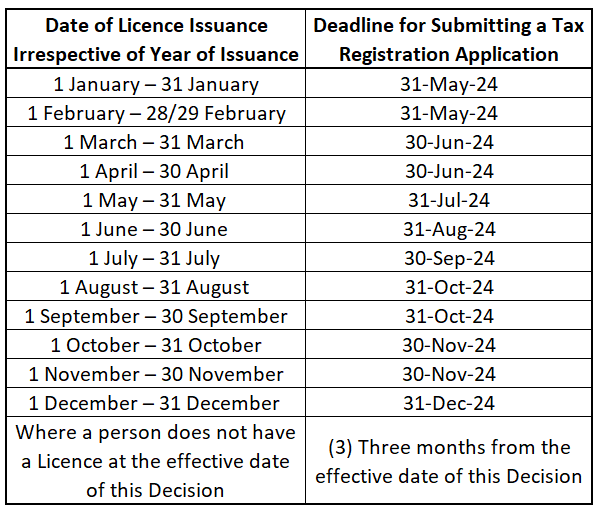

Timeline for the Tax Registration – Resident Juridical Persons

A juridical person that is a Resident Person, incorporated or otherwise established or recognised prior to the effective date of this Decision, shall submit the Tax Registration application, in accordance with the following table:

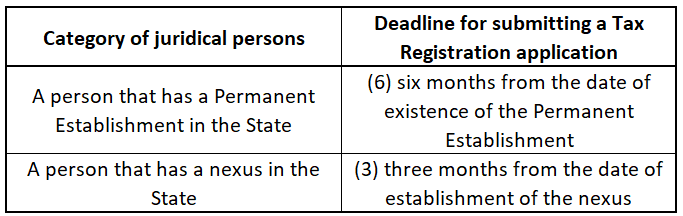

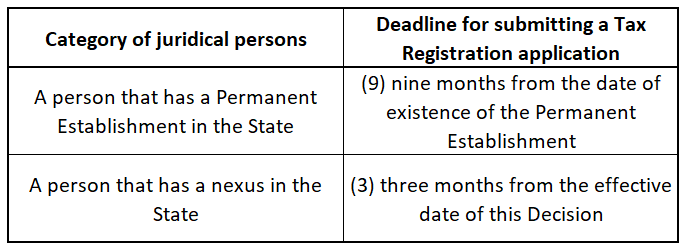

Timeline for the Tax Registration – Non Resident Juridical Persons

A juridical person, that is a Non-Resident Person prior to the effective date of this Decision, shall submit a Tax Registration application in accordance with the following table:

A juridical person, that is a Non-Resident Person on or after the effective date of this Decision, shall submit a Tax Registration application in accordance with the following table: