In the UAE’s dynamic regulatory ecosystem, financial auditing have evolved from a formality into a legal and strategic necessity. With the introduction of Ministerial Decision No. 84 of 2025, the enforcement of Corporate Tax, and Free Zone authorities ramping up audit submission mandates, the cost of non-compliance is higher than ever.

For startups, SMEs, Free Zone entities, and growing mainland companies, understanding UAE audit requirements in 2025 — and partnering with an expert like ProAct Chartered Accountants — is essential for staying compliant, tax-efficient, and audit-ready.

🌟 Who Needs This Guide?

This guide is tailored for:

- ✅ Free Zone companies (especially QFZPs under Ministerial Decision 84)

- ✅ Mainland companies approaching the AED 50M audit threshold

- ✅ Startups & SMEs seeking investment, funding, or tax readiness

- ✅ Holding companies and multinationals with UAE operations

- ✅ Businesses preparing for VAT and Corporate Tax audits

📈 What’s New in UAE Auditing for 2025?

✅ Ministerial Decision No. 84 of 2025: Audit Requirement for QFZPs & Tax Groups

Ministerial Decision No. 84 mandates:

- All Qualifying Free Zone Persons (QFZPs) must submit audited financial statements to retain their 0% Corporate Tax rate.

- Tax Groups, regardless of revenue, must prepare special purpose audited financial statements under IFRS.

Audits must be conducted by a registered auditor approved by the UAE Ministry of Finance.

🔗 Learn more about ProAct’s Free Zone audit expertise

✅ Corporate Tax (CT) Law: 9% on Profits Over AED 375,000

- Applies to all taxable persons.

- Audited financials are critical for:

- Proving revenue/profit thresholds.

- Claiming Small Business Relief (SBR).

- Supporting tax filings and assessments.

✅ Free Zone Audit Mandates for License Renewal

Free Zones like DMCC, DIFC, JAFZA, IFZA, RAKEZ now require audit reports as part of annual renewal. Some zones (e.g., DMCC) set shorter internal deadlines (3–6 months), even though the CT Law allows 9 months post year-end.

🔎 What Is a Financial Audit?

A financial auditing is an independent evaluation of a company’s financial statements to ensure:

- Accuracy of records.

- Compliance with International Financial Reporting Standards (IFRS).

- Transparent reporting for tax, investor, and regulatory purposes.

Types of clients served by ProAct:

- Free Zone entities (DMCC, DIFC, IFZA, RAKEZ, etc.)

- Mainland LLCs and branches

- Holding structures

- E-commerce & digital businesses

📅 Why Choose ProAct for Your UAE Audit?

Unique Advantages of ProAct:

| USP | Benefit |

|---|---|

| ✅ Free Zone Audit Specialists | DMCC, DIFC, IFZA, RAKEZ expertise |

| ✅ Audit Turnaround in 5–10 Days | Fast, FTA-compliant reporting |

| ✅ IFRS-Compliant Audit Reports | Accepted by Free Zones, banks, FTA |

| ✅ Integrated Audit + Tax Team | Simplifies CT & VAT filing |

| ✅ Transparent Fixed Pricing | No hidden charges or delays |

| ✅ 100% UAE-Based Experts | Local knowledge, global standards |

🔗 Explore our accounting services

🏛️ Types of Audits Offered

- Statutory Audit (FTA/Free Zone compliant)

- Special Purpose Audit (for mergers, financing, tax groups)

- Internal Control Audits

- VAT/Corporate Tax Readiness Audits

✅ All reports follow IFRS & are signed by MoF-registered auditors.

⚖️ Mandatory Audit Requirements in 2025

| Company Type | Audit Required? | Legal Basis |

| QFZPs | ✅ Yes | MD 84 of 2025 |

| Tax Groups | ✅ Yes | Special purpose audit required |

| Mainland > AED 50M | ✅ Yes | Per CT Law + MD 82 |

| Free Zone (non-QFZP) | ⚠️ Often | Check Free Zone rules |

| SMEs < AED 3M | ❌ Not mandatory | Recommended for SBR & funding |

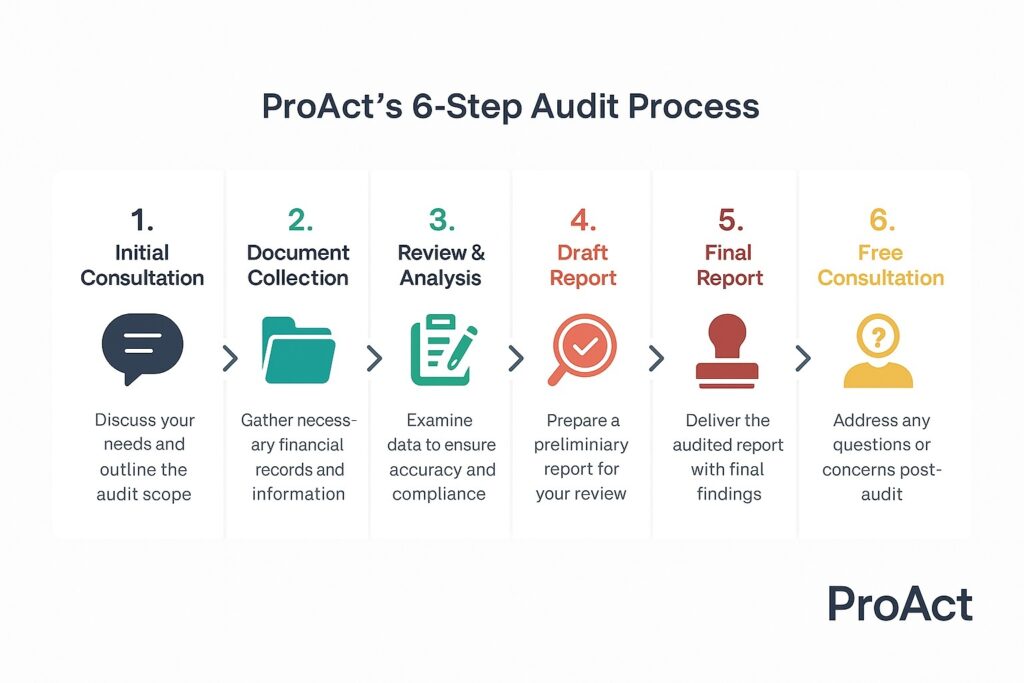

🔧 How the ProAct Audit Process Works

📋 Step-by-Step Process:

- Initial Consultation – Understanding your business, deadlines, and goals

- Document Collection – Financials, bank statements, trade license, etc.

- Review & Analysis – IFRS-based examination of transactions

- Draft Audit Report – For your review, before final sign-off

- Final Report Issuance – With stamp, ready for submission

- Free Consultation – On tax implications and next steps

💡 Free “UAE Audit Preparation Checklist (PDF) – Download

🤖 Smart Compliance: How ProAct Uses Technology

- ✅ Cloud-based audit workflows

- ✅ Zoho Books, QuickBooks, Tally-compatible

- ✅ Digital document sharing + e-signatures

- ✅ Automated compliance checklists

- ✅ Fast turnaround via secure portals

💬 What Our Clients Say

🗣️ “The team at ProAct made our audit stress-free. Everything was online, seamless, and clear. They’re now our go-to for all accounting and audit work.”

— Founder, Dubai Based IT Software Company

🗣️ “We needed a fast auditing for our DMCC company before our license renewal — ProAct got it done in 5 days and guided us on tax readiness too. Couldn’t be more satisfied.”

— CEO, Sharjah Based Consultancy Firm.

📍 UAE Audit Deadlines You Shouldn’t Miss

| Requirement | Deadline |

|---|---|

| Free Zone Audit (QFZP) | Within 9 months of year-end |

| Corporate Tax Return | Within 9 months of financial year-end |

| VAT Return (Quarterly) | 28 days post quarter |

| Ultimate Beneficial Owner (UBO) Updates | Ongoing |

⏳ Missing audit deadlines may lead to fines of AED 10,000+.

💼 Strategic Benefits of an Audit

- ✅ Improve financial transparency

- ✅ Enhance investor/bank confidence

- ✅ Avoid FTA penalties and audits

- ✅ Secure Free Zone tax benefits

- ✅ Improve internal processes and controls

📣 Contact ProAct Now!

- 🔹 Ready to audit your Free Zone company? Contact ProAct now for a free consultation.

- 🔹 Need a fast, affordable UAE audit? Let’s talk.

- 🔹 Book a free audit readiness call with ProAct’s team today.

- 🔹 Not sure if your company needs an audit? Get a free eligibility check.

📚 Frequently Asked Questions (FAQs)

1. Do I need an audit as a Free Zone company in the UAE?

Yes, if you are a Qualifying Free Zone Person (QFZP), you are required to submit audited financials as per Ministerial Decision 84 of 2025.

2. Is audit mandatory for UAE mainland companies?

Only if your turnover exceeds AED 50 million, or if required by stakeholders like banks or investors.

3. Who can conduct audits in DMCC, JAFZA, DIFC, or RAKEZ?

Only auditors approved by the respective Free Zone authority.

4. What is the cost of a financial audit in UAE?

Audit fees vary by business size, but ProAct offers packages starting from AED 3,000 for small companies.

5. What documents are required for a UAE audit?

Typical requirements include bank statements, trial balance, VAT returns, trade license, MOA, invoices, and ledger.

6. How long does a UAE audit take?

At ProAct, standard audit turnaround is 5–10 working days after receiving complete documentation.

7. Can an auditing help reduce UAE Corporate Tax?

Yes. Proper audited statements can help you claim exemptions like Small Business Relief and prove QFZP status.

8. What is an IFRS-compliant audit?

It means your financials are audited according to International Financial Reporting Standards, which is required in the UAE.

9. Do startups in UAE need an audit?

Legally not mandatory below AED 50M turnover, but advisable for investors, compliance, or funding.

10. What happens if I skip audit submission in Free Zone?

Your 0% tax eligibility can be revoked, and you may face fines or license renewal blocks.

11. Can I do a UAE audit remotely?

Yes. ProAct handles audits 100% digitally using secure portals, e-signatures, and cloud storage.

12. Is an auditing required for bank loan approval in UAE?

Yes. Most banks request 1–2 years of audited financials before issuing business loans.

13. Are all Free Zones enforcing audit rules in 2025?

Yes. Almost all major Free Zones have made audit submission mandatory for license renewal.

14. What is the difference between internal and external audit?

External (statutory) audit is required for compliance; internal audit focuses on operations, risk, and process efficiency.

15. Does ProAct offer VAT and tax audit support?

Absolutely. We prepare businesses for both VAT and Corporate Tax audits by the FTA.

16. What is an audit trail and why does it matter?

An audit trail is a record of all transactions. It ensures transparency and simplifies the audit process.

17. Is there a penalty for not submitting an audit report in UAE?

Yes. Penalties can exceed AED 10,000, and your Free Zone license may not renew.

18. Can ProAct audit multiple branches or group companies?

Yes. We offer consolidated audits for holding companies and multi-entity groups.

19. How to choose the right auditing firm in UAE?

Look for approval in your Free Zone, experience, IFRS knowledge, and local presence.

20. How do I get started with my UAE audit?

Simple. Contact ProAct via our website and we’ll guide you step-by-step — no guesswork, no delays.

🛡️ Disclaimer

This article is intended for general informational purposes only and does not constitute legal or tax advice. For personalized guidance specific to your business and jurisdiction, please consult with the team at ProAct Chartered Accountants.

Author Bio:

Written By,